- August 28, 2011

- Local Market Conditions, Our Blogs

- No Comments

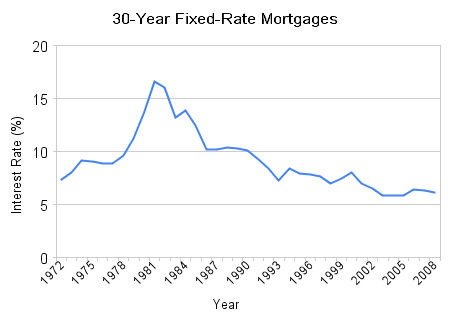

As discussed in our prior blog postings, mortgage interest rates are headed lower. Indeed, the Associated Press put out an article today about new record lows in mortgage rates to confirm this forecasted trend. With the Federal Reserve indicating its intention last week to keep funds rates at near zero percent for up to two more years, this trend is finally getting to be blindingly clear.

Ok, so rates are headed lower. My fellow mortgage brokers are very well aware of that fact, even if my fellow real estate brokers still inexplicably insist on higher rates this year. In any case, with 30 year mortgage rates already near 4%, how low can they really go, at least in theory?

Well, if we look at a bit of historical data, we can see that mortgage rates basically track the Treasury note yields. The gap between the two widens as lenders tighten credit based on perceived default risk of mortgages and the closes as lenders get more complacent, which happened during the heights of the housing bubble. Today, we see that gap widen to record levels as the Federal Reserve accumulates its holdings of Treasuries to drive yields down towards its target rate.

Since the Fed has signaled its intention to maintain its monetary easing policy for the next two years, there’s plenty of room for mortgage rates to fall to close that gap. So, what will make mortgage rates fall? Lenders and their actuaries will have to believe that the default risk of mortgages being originated today will steadily decline, allowing them to make money on lower interest rates. This will likely occur as lending standards have tightened up to pre-bubble levels for the last 2-3 years, returning default risk back towards the long-term average.

So, over the next 1-2 years, if the Fed follows through with its easing, the repricing of risk will tend to lead rates lower by 0.50%-1%. So, it’s conceivable to see 30 year mortgages right below 3%, which is near the bottom that lenders can go in a stable interest rate environment and stay profitable. And, while that may be an amazing deal on long-term debt, the number of qualifying borrowers will likely shrink at the same time. To find out how and when you can take advantage of this unprecedented opportunity, please contact us.